Deciding to Make the Leap from Contractors to Employees in my Professional Organizing Business

- Jen Martin

- Feb 28, 2024

- 4 min read

Updated: Apr 15, 2024

We are not legal counsel or able to give tax advice, and every state has different requirements and laws around contractors and employees, I am just sharing my personal experiences.

Jen here… and sharing my experience of switching all my organizers over to employees a little over a year ago. The first 3 years in business we used a contractor model and had only been operating in the state of Utah. Moving everyone over to employees has added expenses but it has also brought security and I’m glad we did it. Here’s a little behind WHY we made the decision, what we wish we would have known, why we are so glad we did it, and what we might have done differently.

Why we decided to move everyone over to employees:

Our organizers were wearing ‘uniforms’. They wore branded t-shirts and we asked them to wear black pants with their t-shirts.

Our organizers were told when to show up and expected to stay until the job was complete. Even though we have always scattered to the mom-economy and even though our organizers give us their availability before we schedule them on a job, once they are assigned they are expected to show up at a specific time.

It is very important to our brand that we have standards when we organize in others’ homes and that every organizer is trained in our very specific methods.

We give our organizers all the supplies they need on the job (most organizers use an apron we supply and they fill the apron with tools like label scraper, sharpies, post-its, scissors, measuring tape, etc.). Contractors are expected to provide their own supplies.

Our team was growing and we wanted to make sure we were in compliance with employee guidelines.

We wanted to make sure our organizers were not hit with unexpected taxes at the end of the year.

We wanted to make sure our organizers were insured and protected while on the job and we knew most of them didn’t have their own insurance or LLCs created to support their contractor status.

Things I wish I would have known:

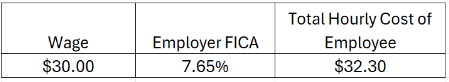

It is expensive: Converting an employee to W-2 means that the company bears ½ of the FICA tax burden. Total FICA taxes are 15.3%, so the company pays an extra 7.65% over the employee pay rate. Below is a chart of an employee who is paid $30 per hour. The total company cost of the employee is $30 plus the 7.65% FICA tax burden. Beyond the FICA burden, there are workers compensation requirements and payroll processing fees.

There are rules about breaks and lunches in different states and we never followed any rules before. It was helpful to consult with experts who understood the laws in different states so we could make sure we were following them.

A few of our organizers (those who did have LLCs) were sad to not be able to write off things like gas money, work clothes, etc.

Why I am so glad I did it:

I have always trained my organizers in my specific methods. I love being able to share with clients that our organizers are taught our methods and held to our very high standards.

We had two accidents happen on the job in 2023 (both of them horrific freak accidents) and I was so grateful that we were able to support those injured with worker’s comp. I can’t imagine the repercussions that would have occurred for the future of my company if we hadn’t been protected.

The IRS is cracking down on this and there could be fines and repercussions for running a business with contractors that you treat as employees.

It is easier to expect things that are important to me from my team. We do regular trainings, we have performance evaluations, our organizers are required to do background checks and sign a code of conduct when hired

If I could do it all over again:

I would grow my team more slowly and strategically. My team is quite large and having them as contractors didn’t impact our expenses, but employees do. I would keep my team smaller and filled with women who want to work 2-5 days a week.

I would have made the switch sooner. I was on the fence for a long time and feel incredibly lucky that we never had an onsite accident until after we had workers comp.

This is a decision that I was scared to make and I coasted by for quite some time before I realized that if I wanted my organizers to show up for my business in a way that was professional, I needed to show up for them. I know every business is different and that is why this post is not intended to give any sort of tax, legal, or financial advice. I do hope that sharing my experience with you has been helpful. What questions do you have?

UPDATE (3/6): Did you know that on March 11, 2024 the final rule on independent contractor classifications will officially be published by the Department of Labor (DOL)?

There is now a six-factor test for determining if a worker should be classified as an independent contractor or employee.

Here are some helpful resources that we hope you will find useful!

This is a good test to find out if someone should be a 1099 or W-2 if they answer yes to most of these, they should be a W-2

This is its website that helps determine if those who work for you should be classified as W-2 or 1099. There are three levels of control: behavioral, financial and type of relationship.

Jen Martin

From a young age, Jen Martin, always loved organizing. As she grew older and had a family of her own, her love and value of an organized home just continued to grow. With four kids of her own, she knows how important organizational systems are to the foundation and well-being of a family's day-to-day life. Jen started Reset Your Nest in 2020 to bring her organizational skills to the rest of Utah. Her team of trained organizers has carefully and lovingly transformed the homes of over 500 homes. Jen has been featured on numerous television shows, podcasts, blogs, and books including Organized Living by Shira Gill, KSL Studio 5, AG Clever, and more.

Comments